Apply the SR 11-7 guidance for model risk management

SR 11-7 is a supervisory guidance for model risk management (MRM) published by the Federal Reserve (Fed) and the Office of the Comptroller of the Currency (OCC). In 2011, the Fed and the OCC jointly published SR 11-7 as a supervisory guidance for model risk management (MRM). The “principles-based” guidance articulates the elements of a sound program for effective management of risks that arise when using quantitative models in bank decision-making.

SR 11-7 applies to national banks, state banks, bank holding companies, and all other institutions for which the Fed or OCC is the primary supervisor.

Recognizing the importance of model risk and its impact on financial systems, other countries have published their local guidance similar to SR 11-7, including:

- SS 3/18 by the UK PRA in April 2018

- TRIM by the ECB in February 2017

- E-23 by the Canadian OSFI in September 2017

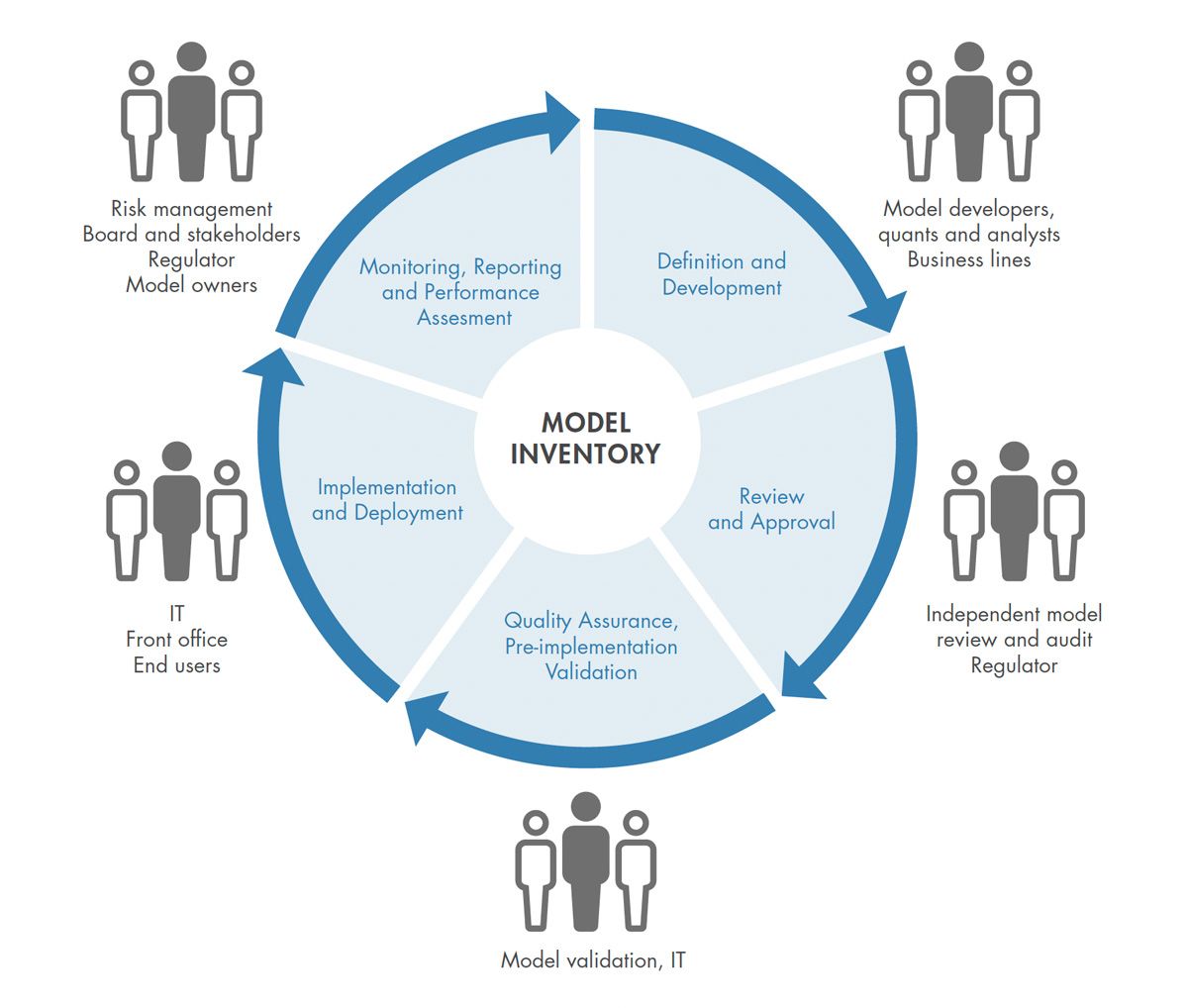

The SR 11-7 guidance covers the entire model lifecycle including model development, implementation, and use; model validation; and model governance, policies, and controls. Figure 1 shows different components of the model lifecycle with a centralized model inventory and the stakeholders aligned with each component.

Since SR 11-7 was published, banks have invested significant time and capital implementing the guidance and still face several challenges, including:

- Handling data and documentation

- Reproducing, interpreting, and validating model results

- Accelerating and scaling implementation

- Monitoring model performance in real time

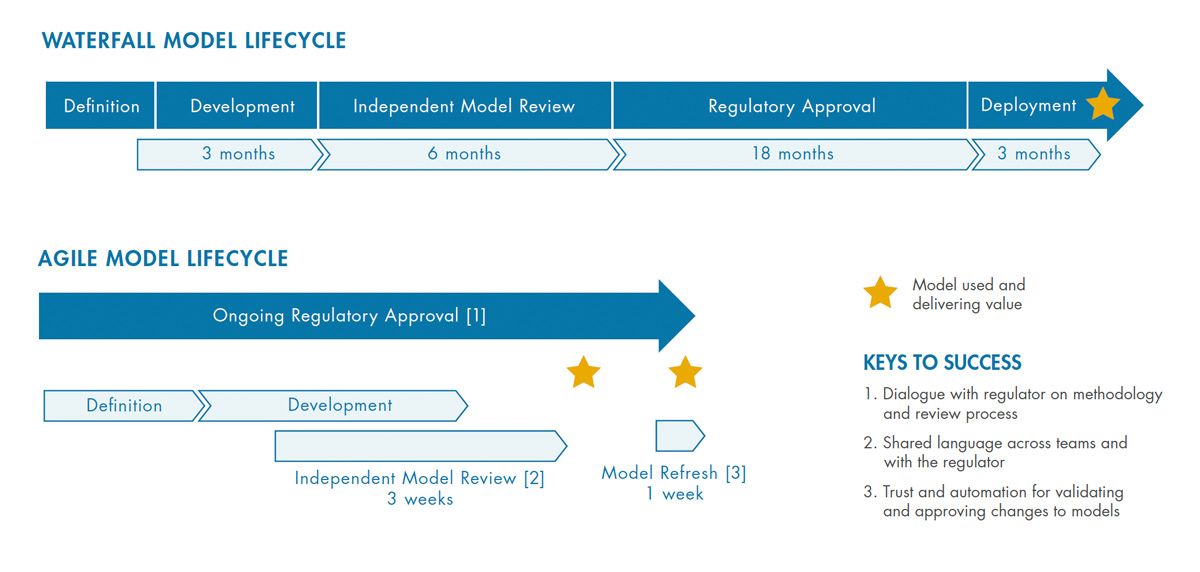

The challenges related to SR 11-7 are described in the white paper Effective Model Risk Management. The paper also highlights how transitioning from a waterfall-based model lifecycle to an agile model lifecycle reduces cost and facilitates compliance, as shown in Figure 2.

Figure 2. Agile implementation of SR 11-7 guidance.

Considering the challenges and global regulatory practices—including SR 11-7, EU TRIM, OSFI E-23, SS 3/18, and industry best practices on MRM—bat365 developed the Modelscape solution to develop, validate, deploy, monitor, and manage models quickly and efficiently.

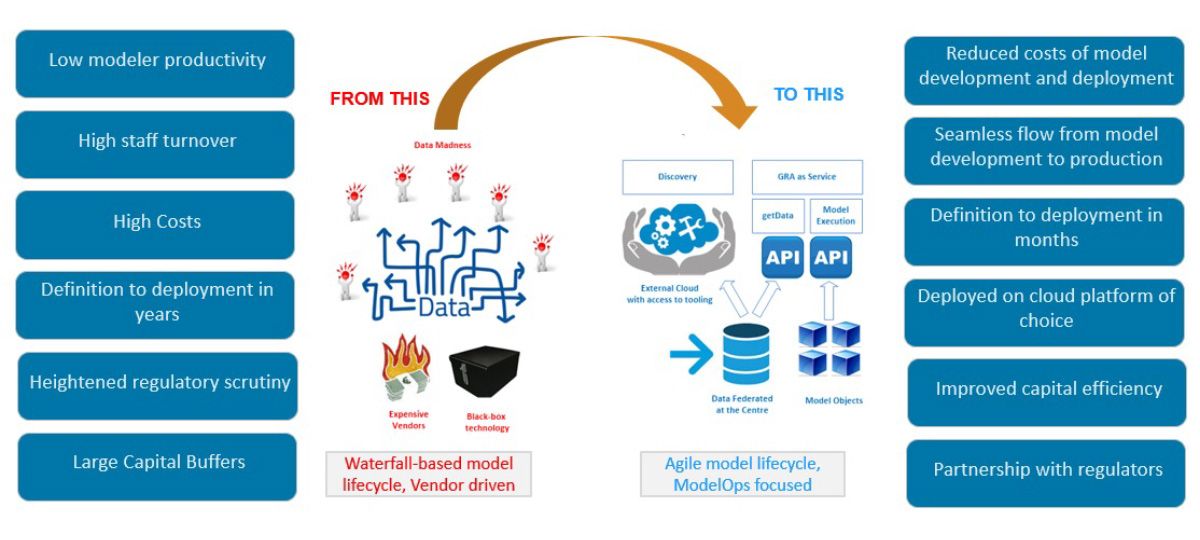

bat365 implemented Modelscape at HSBC’s Group Risk Analytics division for access by users globally, while helping the bank in transitioning from waterfall-based MRM to agile MRM, as shown in Figure 3.

Figure 3. Transitioning from waterfall to agile SR 11-7 implementation.

Ray O’Brien, HSBC Global COO, shared his vision of agile MRM and how HSBC uses MATLAB to adapt to strategic and regulatory changes: Financial Risk Management and Model-Based Design (1:30).

Because of its efforts, bat365 was named a category leader in the Chartis RiskTech Quadrant for OpRisk solutions in 2021, as shown in Figure 4.

Examples and How To

Software Reference

See also: Modelscape