backtestEngine

Create backtestEngine object to backtest strategies and

analyze results

Since R2020b

Description

Create a backtestEngine to run a backtest of portfolio

investment strategies on historical data.

Use this workflow to develop and run a backtest:

Define the strategy logic using a

backtestStrategyobject to specify how a strategy rebalances a portfolio of assets.Use

backtestEngineto create abacktestEngineobject that specifies parameters of the backtest.Use

runBacktestto run the backtest against historical asset price data and, optionally, trading signal data.Use

equityCurveto plot the equity curves of each strategy.Use

summaryto summarize the backtest results in a table format.

For more detailed information on this workflow, see Backtest Investment Strategies Using Financial Toolbox.

Creation

Description

backtester = backtestEngine(strategies)backtestEngine object. Use the

backtestEngine object to backtest the portfolio

trading strategies defined in the backtestStrategy objects.

backtester = backtestEngine(___,Name,Value)backtester =

backtestEngine(strategies,'RiskFreeRate',0.02,'InitialPortfolioValue',1000,'RatesConvention',"Annualized",'Basis',2).

Input Arguments

strategies — Backtest strategies

vector of backtestStrategy objects

Backtest strategies, specified as a vector of backtestStrategy objects. Each backtestStrategy object defines a portfolio trading

strategy.

Data Types: object

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: backtester =

backtestEngine(strategies,'RiskFreeRate',0.02,'InitialPortfolioValue',1000,'RatesConvention',"Annualized",'Basis',2)

RiskFreeRate — Risk free rate

0 (default) | numeric | timetable

Risk free rate, specified as the comma-separated pair consisting

of 'RiskFreeRate' and a scalar numeric or a

one-column timetable.

Note

If you specify a timetable:

The dates in the specified

timetablemust include the start and end dates of the backtest.The series of dates in the specified timetable between the start and end dates (inclusive) must correspond exactly to the corresponding series of dates in the

assetPricestimetable.

If RatesConvention is

"Annualized", then

RiskFreeRate specifies an annualized

rate.

If RatesConvention is

"PerStep", then the

RiskFreeRate is a decimal percentage and

represents the risk free rate for one time step in the backtest. For

example, if the backtest uses daily asset price data, then the

RiskFreeRate value must be the daily rate of

return for cash.

Data Types: double | timetable

CashBorrowRate — Cash borrowing rate

0 (default) | numeric | timetable

Cash borrowing rate, specified as the comma-separated pair

consisting of 'CashBorrowRate' and a scalar

numeric or a one-column timetable.

Note

If you specify a timetable:

The dates in the specified

timetablemust include the start and end dates of the backtest.The series of dates in the specified timetable between the start and end dates (inclusive) must correspond exactly to the corresponding series of dates in the

assetPricestimetable.

The CashBorrowRate specifies the rate of

interest accrual on negative cash balances (margin) during the

backtest.

If RatesConvention is

"Annualized", then

CashBorrowRate specifies an annualized

rate.

If RatesConvention is

"PerStep", then the

CashBorrowRate value is a decimal percentage

and represents the interest accrual rate for one time step in the

backtest. For example, if the backtest is using daily asset price

data, then the CashBorrowRate value must be the

daily interest rate for negative cash balances.

Data Types: double | timetable

InitialPortfolioValue — Initial portfolio value

10000 (default) | numeric

Initial portfolio value, specified as the comma-separated pair

consisting of 'InitialPortfolioValue' and a

scalar numeric.

Data Types: double

RatesConvention — Defines how backtest engine uses RiskFreeRate and CashBorrowRate to compute interest

"Annualized" (default) | character vector with value 'Annualized' or

'PerStep' | string with value "Annualized" or

"PerStep"

Since R2021a

Defines how backtest engine uses RiskFreeRate

and CashBorrowRate to compute interest,

specified as the comma-separated pair consisting of

'RatesConvention' and a character vector or string.

'Annualized'— The rates are treated as annualized rates and the backtest engine computes incremental interest based on the day count convention specified in theBasisproperty. This is the default.'PerStep'— The rates are treated as per-step rates and the backtest engine computes interest at the provided rates at each step of the backtest.

Data Types: char | string

DateAdjustment — Date handling behavior for rebalance dates that are missing from asset prices timetable

"Previous" (default) | character vector with value 'Previous',

'Next', or 'None' | string with value "Previous",

"Next", or "None"

Since R2022a

Date handling behavior for rebalance dates that are missing from

asset prices timetable, specified as the comma-separated pair

consisting of 'DateAdjustment' and a character

vector or string.

'Previous'— For each rebalance date in the rebalance schedule, the rebalance occurs on the nearest date in the asset timetable that occurs on or before the requested rebalance date. This is the default.'Next'— Move to the next date.'None'— Dates are not adjusted and the backtest engine errors when encountering a rebalance date that does not appear in the asset prices timetable.

Data Types: char | string

Basis — Defines day-count convention when computing interest at RiskFreeRate or

CashBorrowRate

0 (default) | numeric values: 0,1,

2, 3,

4, 6, 7,

8, 9,

10, 11,

12, 13

Since R2021a

Defines the day-count convention when computing interest at the

RiskFreeRate or

CashBorrowRate, specified as the

comma-separated pair consisting of 'Basis' and a

scalar integer using a supported value:

0 = actual/actual

1 = 30/360 (SIA)

2 = actual/360

3 = actual/365

4 = 30/360 (PSA)

5 = 30/360 (ISDA)

6 = 30/360 (European)

7 = actual/365 (Japanese)

8 = actual/actual (ICMA)

9 = actual/360 (ICMA)

10 = actual/365 (ICMA)

11 = 30/360E (ICMA)

12 = actual/365 (ISDA)

13 = BUS/252

For more information, see Basis.

Note

Basis is only used when the

RatesConvention property is set to

"Annualized". If the

RatesConvention is

"PerStep", and

Basis is set,

backtestEngine ignores the

Basis value.

Data Types: double

PayExpensesFromCash — Indicates if transaction expenses paid from cash account or by reducing portfolio value

false (default) | true or false

Since R2023b

Indicates if backtest expenses (transaction costs or fees) are

paid from cash account or by reducing the total portfolio value,

specified as the comma-separated pair consisting of

'PayExpensesFromCash' and a logical

value.

If set to false (the default), backtest

expenses are paid by reducing the total portfolio value. This allows

the backtest engine to pay for expenses while maintaining the

strategy allocation weights exactly.

If set to true, the backtest engine pays all

expenses from one or more cash accounts

(CashAssets) or debt accounts

(DebtAssets). This happens as follows:

If user-controlled cash assets are not specified (that is, the

CashAssetsorDebtAssetsparameters forrunBacktestare not set), then expenses are paid from the unallocated cash account. This is the default behavior. The unallocated cash account contains the remaining portfolio value when thebacktestStrategyrebalance function returns portfolio weights that do not sum to1. Unallocated cash earns theRiskFreeRate(orCashBorrowRateif it goes negative).If user-controlled cash assets are specified (that is,

CashAssetsorDebtAssetsparameters forrunBacktestare set), then expenses are paid using the first specified cash asset if it has sufficient funds. If not, the first cash asset is set to $0and the engine moves on to the second cash asset, continuing in this way until the expense is paid. Once allCashAssetsare exhausted and if some expense remains unpaid, then the first specifiedDebtAssetincurs all remaining expenses. If noDebtAssetis specified, then the final cash asset goes negative to pay any remaining expense.

Data Types: logical

Properties

Strategies — Backtest strategies

vector of backtestStrategy objects

Backtest strategies, specified as a vector of backtestStrategy objects.

Data Types: object

RiskFreeRate — Risk free rate

0 (default) | numeric | timetable

Risk free rate, specified as a scalar numeric or timetable.

Data Types: double

CashBorrowRate — Cash borrowing rate

0 (default) | numeric | timetable

Cash borrowing rate, specified as a scalar numeric or timetable.

Data Types: double

InitialPortfolioValue — Initial portfolio value

10000 (default) | numeric

Initial portfolio value, specified as a scalar numeric.

Data Types: double

AnnualizedRates — Use annualized rates for RiskFreeRate and CashBorrowRate

true (default) | logical with value true or

false

Use annualized rates for RiskFreeRate and

CashBorrowRate, specified as a scalar

logical.

Data Types: logical

DateAdjustment — Date handling behavior for rebalance dates that are missing from asset prices timetable

"Previous" (default) | string with value "Previous",

"Next", or "None"

Date handling behavior for rebalance dates that are missing from asset prices timetable, specified as a string.

Data Types: char | string

Basis — Day-count basis of annualized rates for RiskFreeRate and CashBorrowRate

0 (default) | numeric values: 0,1,

2, 3, 4,

6, 7, 8,

9, 10, 11,

12, 13

Day-count of annualized rates for RiskFreeRate and

CashBorrowRate, specified a scalar integer.

Data Types: double

NumAssets — Number of assets in portfolio universe

[] (default) | numeric

This property is read-only.

Number of assets in the portfolio universe, a numeric.

NumAssets is derived from the timetable of adjusted

prices passed to runBacktest.

NumAssets is empty until you run the backtest using

the runBacktest

function.

Data Types: double

Returns — Strategy returns

[] (default) | timetable

This property is read-only.

Strategy returns, a

NumTimeSteps-by-NumStrategies

timetable of strategy returns. Returns are per time step. For example, if

you use daily prices with runBacktest,

then Returns is the daily strategy returns.

Returns is empty until you run the backtest using the

runBacktest

function.

Data Types: timetable

Positions — Asset positions for each strategy

[] (default) | structure

This property is read-only.

Asset positions for each strategy, a structure containing a

NumTimeSteps-by-NumAssets

timetable of asset positions for each strategy. For example, if you use

daily prices in the runBacktest,

then the Positions structure holds timetables containing

the daily asset positions. Positions is empty until you

run the backtest using the runBacktest

function.

Data Types: struct

Turnover — Strategy turnover

[] (default) | timetable

This property is read-only.

Strategy turnover, a

NumTimeSteps-by-NumStrategies

timetable. Turnover is empty until you run the backtest

using the runBacktest

function.

Data Types: timetable

BuyCost — Transaction costs for asset purchases of each strategy

[] (default) | timetable

This property is read-only.

Transaction costs for the asset purchases of each strategy, a

NumTimeSteps-by-NumStrategies

timetable. BuyCost is empty until you run the backtest

using the runBacktest

function.

Data Types: timetable

SellCost — Transaction costs for asset sales of each strategy

[] (default) | timetable

This property is read-only.

Transaction costs for the asset sales of each strategy, a

NumTimeSteps-by-NumStrategies

timetable. SellCost is empty until you run the backtest

using the runBacktest

function.

Data Types: timetable

Fees — Paid fees for management and performance fees

[] (default) | struct

Since R2022b

This property is read-only.

Paid fees for management and performance fees, a struct containing a

timetable for each strategy which holds all the fees paid by the strategy.

The Fees timetable contains an entry for each date where

at least one fee was paid. Each column holds the amount paid for a

particular type of fee. If no fees are paid, then the

Fees timetable is empty.

For more information on management and performance fees defined using a

backtestStrategy object, see Management Fees, Performance Fees, and Performance Hurdle.

Data Types: timetable

PayExpensesFromCash — Indicates if transaction expenses paid from cash account or by reducing portfolio value

false (default) | true or false

Since R2023b

This property is read-only.

Indicates if backtest expenses (transaction costs or fees) are paid from cash account or by reducing the total portfolio value, a logical value.

Data Types: logical

TransactionCosts — Detailed transaction costs

[] (default) | struct

Since R2023b

This property is read-only.

Detailed transaction costs for per-asset transaction costs for strategy, a

struct containing a timetable of detailed, per-asset transaction costs for

each strategy. The TransactionCosts timetables contain

one row for each rebalance date and one column for each asset.

If the strategy generates aggregate transaction costs, then the

TransactionCosts timetable for that strategy is

empty.

Data Types: timetable

Object Functions

runBacktest | Run backtest on one or more strategies |

summary | Generate summary table of backtest results |

equityCurve | Plot equity curves of strategies |

Examples

Backtest Strategy Using backtestEngine

Use a backtesting engine in MATLAB® to run a backtest on an investment strategy over a time series of market data. You can define a backtesting engine by using backtestEngine object. A backtestEngine object sets properties of the backtesting environment, such as the risk-free rate, and holds the results of the backtest. In this example, you can create a backtesting engine to run a simple backtest and examine the results.

Create Strategy

Define an investment strategy by using the backtestStrategy function. This example builds a simple equal-weighted investment strategy that invests equally across all assets. For more information on creating backtest strategies, see backtestStrategy.

% The rebalance function is simple enough that you can use an anonymous function equalWeightRebalanceFcn = @(current_weights,~) ones(size(current_weights)) / numel(current_weights); % Create the strategy strategy = backtestStrategy("EqualWeighted",equalWeightRebalanceFcn,... 'RebalanceFrequency',20,... 'TransactionCosts',[0.0025 0.005],... 'LookbackWindow',0)

strategy =

backtestStrategy with properties:

Name: "EqualWeighted"

RebalanceFcn: @(current_weights,~)ones(size(current_weights))/numel(current_weights)

RebalanceFrequency: 20

TransactionCosts: [0.0025 0.0050]

LookbackWindow: 0

InitialWeights: [1x0 double]

ManagementFee: 0

ManagementFeeSchedule: 1y

PerformanceFee: 0

PerformanceFeeSchedule: 1y

PerformanceHurdle: 0

UserData: [0x0 struct]

EngineDataList: [0x0 string]

Set Backtesting Engine Properties

The backtesting engine has several properties that you set by using parameters to the backtestEngine function.

Risk-Free Rate

The RiskFreeRate property holds the interest rate earned for uninvested capital (that is, cash). When the sum of portfolio weights is below 1, the remaining capital is invested in cash and earns the risk-free rate. The risk-free rate and the cash-borrow rate can be defined in annualized terms or as explicit "per-time-step" interest rates. The RatesConvention property is used to specify how the backtestEngine interprets the two rates (the default interpretation is "Annualized"). For this example, set the risk-free rate to 2% annualized.

% 2% annualized risk-free rate

riskFreeRate = 0.02;Cash Borrow Rate

The CashBorrowRate property sets the interest accrual rate applied to negative cash balances. If at any time the portfolio weights sum to a value greater than 1, then the cash position is negative by the amount in excess of 1. This behavior of portfolio weights is analogous to borrowing capital on margin to invest with leverage. Like the RiskFreeRate property, the CashBorrowRate property can either be annualized or per-time-step depending on the value of the RatesConvention property.

% 6% annualized margin interest rate

cashBorrowRate = 0.06;Initial Portfolio Value

The InitialPortfolioValue property sets the value of the portfolio at the start of the backtest for all strategies. The default is $10,000.

% Start backtest with $1M

initPortfolioValue = 1000000;Create Backtest Engine

Using the prepared properties, create the backtesting engine using the backtestEngine function.

% The backtesting engine takes an array of backtestStrategy objects as the first argument backtester = backtestEngine(strategy,... 'RiskFreeRate',riskFreeRate,... 'CashBorrowRate',cashBorrowRate,... 'InitialPortfolioValue',initPortfolioValue)

backtester =

backtestEngine with properties:

Strategies: [1x1 backtestStrategy]

RiskFreeRate: 0.0200

CashBorrowRate: 0.0600

RatesConvention: "Annualized"

Basis: 0

InitialPortfolioValue: 1000000

DateAdjustment: "Previous"

PayExpensesFromCash: 0

NumAssets: []

Returns: []

Positions: []

Turnover: []

BuyCost: []

SellCost: []

TransactionCosts: []

Fees: []

Several additional properties of the backtesting engine are initialized to empty. The backtesting engine populates these properties, which contain the results of the backtest, upon completion of the backtest.

Load Data and Run Backtest

Run the backtest over daily price data from the 30 component stocks of the DJIA.

% Read table of daily adjusted close prices for 2006 DJIA stocks T = readtable('dowPortfolio.xlsx'); % Remove the DJI index column and convert to timetable pricesTT = table2timetable(T(:,[1 3:end]),'RowTimes','Dates');

Run the backtest using the runBacktest function.

backtester = runBacktest(backtester,pricesTT)

backtester =

backtestEngine with properties:

Strategies: [1x1 backtestStrategy]

RiskFreeRate: 0.0200

CashBorrowRate: 0.0600

RatesConvention: "Annualized"

Basis: 0

InitialPortfolioValue: 1000000

DateAdjustment: "Previous"

PayExpensesFromCash: 0

NumAssets: 30

Returns: [250x1 timetable]

Positions: [1x1 struct]

Turnover: [250x1 timetable]

BuyCost: [250x1 timetable]

SellCost: [250x1 timetable]

TransactionCosts: [1x1 struct]

Fees: [1x1 struct]

Examine Results

The backtesting engine populates the read-only properties of the backtestEngine object with the backtest results. Daily values for portfolio returns, asset positions, turnover, transaction costs, and fees are available to examine.

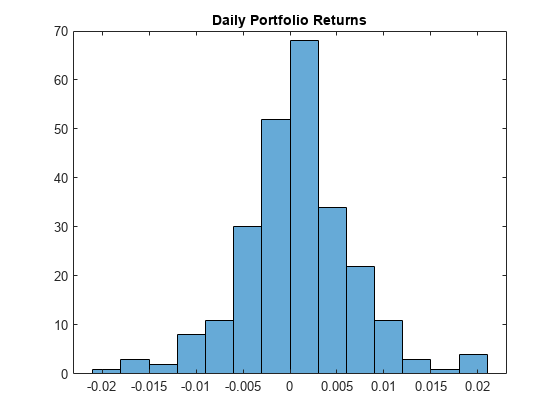

Examine the daily returns.

% Generate a histogram of daily portfolio returns histogram(backtester.Returns{:,1}) title('Daily Portfolio Returns')

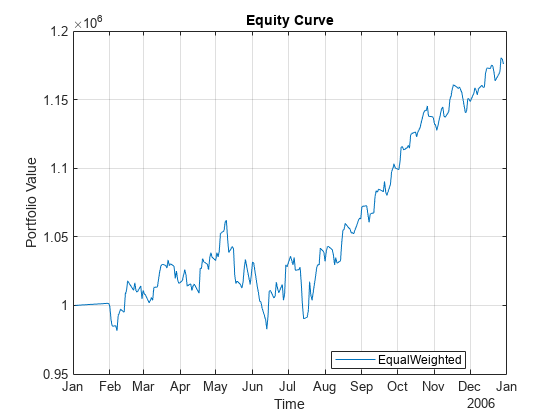

Use equityCurve to plot the equity curve for the simple equal-weighted investment strategy.

equityCurve(backtester)

Version History

Introduced in R2020bR2023b: Detailed transaction costs

The backtestEngine object supports a read-only property for

TransactionCosts to contain per-asset transaction costs for

each rebalance date.

R2023b: User-controlled cash handling

The backtestEngine object supports a read-only property for

ExpensesPaidFromCash to indicate if transaction expenses

are paid from a cash account or debt account.

R2022b: Management and performance fees

The backtestEngine object supports a read-only property for

Feesthat reports the management and performance fees paid

during a backtest. The Fees property is a struct containing a

timetable for each strategy and the timetable holds all the fees paid by the

strategy.

R2022a: Specify time varying cash rates of return

The backtestEngine name-value arguments for

RiskFreeRate and CashBorrowRate

support a timetable data type.

R2022a: Control how the backtesting framework handles missing rebalance dates

The name-value argument for DateAdjustment enables you to

control the date handling behavior for rebalance dates that are missing from the

assetPrices timetable. If a rebalance date falls on a

holiday, you can specify the "Next" or "None"

option for DateAdjustment.

Open Example

You have a modified version of this example. Do you want to open this example with your edits?

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list:

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other bat365 country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)